REIMAGINING COMMERCIAL ENGAGEMENTS FOR UNICREDIT

Blending Technology and Empathy: A Journey into Enhanced Commercial Engagement in Digital Banking

Client

Unicredit

Scoop

Product Design

UX/UI

Innovation

Sector

Finance

Introduction: Unicredit, a renowned name in the banking industry, has a sprawling digital presence with millions of users interacting with its app daily. With services spread across various countries, Unicredit aimed to modernize its commercial engagement features and align them seamlessly for a consistent and user-centric experience. As a Product Designer, I had the opportunity to lead this transformation, updating its commercial engagement features within the mobile app and paving the way for future evolution.

My Role: As a Product Designer leading this stream, I was tasked with envisioning and executing the unified Commercial Engagement Ecosystem. Collaborating with a talented pool of individuals, from my experienced and visionary manager Alessandro Previati and brilliant service designer Ana Maria Diaz, to UniCredit Governance from Italy and all country representatives, our journey was rooted in collective innovation.

We embarked on the journey of analyzing, ideating, and crafting a brand new commercial engagement. The process involved:

1- Mapping user actions and behaviors within the app.

2- Working with AI and data-driven techniques to create a personalized recommendation system.

3- Creating guidelines for a human-centric approach based on user research.

4- Collaborating with representatives from various countries to understand regional preferences and priorities.

Disclaimer: Before diving deep, I must mention that to adhere to my confidentiality obligations, certain details in this case study have been omitted. All opinions and interpretations are personal and do not necessarily represent Unicredit's views.

CONTEXT

From Disparity to Unity

For a multinational bank such as Unicredit, which boasts an expansive global footprint, delivering a consistent and unified user experience is crucial. Over the years, Unicredit developed a plethora of commercial engagement features, each crafted at distinct times to meet the requirements of the diverse markets they catered to. As a result, their previous commercial engagement suite became a mosaic of features, reflecting different technological trends and shifting customer tastes. However, while these features served their purpose in isolation, they needed a unified vision, and prevention of ending up with fragmented user experiences.

As commercial engagements became increasingly important for Unicredit's business strategy, there was a clear push to enhance these commercial activities. This shift underscored the need to modernize and unify the bank's commercial engagement suite. Although, like many global corporations, the hurdle for Unicredit was to execute this digital evolution while addressing the varied business requirements across diverse markets.

The task ahead was multifaceted: to refine existing features, anticipate future needs, modernize certain tools, phase out others, and pioneer new innovative solutions. This demanded a profound comprehension of user behaviors, needs, and an insight into competitor strategies as well as a collaboration between UniCredit stakeholders representing each country for a shared vision.

CHALLANGE

The Bridge Between Banking & Human Touch

In the highly competitive and rapidly evolving landscape of digital banking, UniCredit faced a multifaceted challenge. The bank sought to innovate its realm of commercial engagement, while ensuring a seamless and user-centric experience for its diverse clientele spanning multiple countries.

Key challenges included:

1.

Balancing Commercial Goals with User Experience

Striking the right balance between driving commercial objectives and ensuring the digital experience remains user-friendly, non-intrusive, and respectful of user privacy.

2.

Unified System

The challange was to consolidate and restructure Unicredit's commercial offerings in the app, ensuring they operate as a harmonized system. This involved modernizing existing features, discarding unnecessary ones.

3.

Tech Integration

Seamlessly integrating AI-driven recommendations without overwhelming or alienating users, and ensuring these technological advancements complemented, rather than replaced, the human touch.

4.

Future Proofing

Designing a system that not only addressed immediate needs but was also adaptable and scalable to future innovations in the banking sector.

5.

Stakeholder Collaboration

Working cohesively with stakeholders from various countries, gathering their insights, and aligning them with the bank's overarching vision for its digital transformation.

BUSINESS PERSPECTIVE

Unveiling the Business Rationale

In the fast-paced realm of digital banking, striking the right balance between business objectives and user needs is vital. This section offers a lens into the strategic considerations that shaped the design of Unicredit's commercial engagement features. Beyond enhancing user experience, these choices bolster Unicredit's market position, build trust, and drive tangible business results, reflecting the bank's dual commitment to operational excellence and customer-centricity.

1.

Increased Engagement and Sales Conversion

With a streamlined, AI-powered recommendation system, users could find it easier to locate and select products tailored to their needs. This can translate to higher user engagement and a direct impact on sales. Studies suggest that personalized content can lead to a 20% increase in sales (source: Monetate).

2.

Cost Efficiency

In the long run, maintaining and updating a unified system can be more cost-effective than managing disparate systems. This efficiency can translate to savings of up to 25% in IT costs, which is consistent with industry trends where companies modernize their systems according to Gartner reports.

3.

Prioritizing User Trust

For any recommendation system, especially in banking, the users' trust is paramount. Ensuring transparency, respect for privacy, and providing genuinely useful recommendations can significantly enhance customer loyalty and retention. A study by Accenture in 2019 highlighted that 86% of banking customers are satisfied when they trust the bank.

I initiated guidelines to ensure that the product recommendations were perceived positively. The aim was to provide value, respecting user privacy and avoiding an excessively commercial vibe.

4.

Stakeholder Value

As the case study involves collaboration with stakeholders across various countries, the unified system enhances stakeholder value by ensuring that their feedback and regional insights are incorporated, leading to a product that resonates with a wider audience.

5.

Readiness for Future Innovations

The newly structured system, built on scalable architecture, makes it easier for Unicredit to integrate future innovations and improvements. It positions the bank to be agile in response to changing market dynamics and technological advancements.

USER PERSPECTIVE

Drawing from User Research

UniCredit is dedicated to understanding its users, and they regularly conduct User Research through specialized teams. I had the privilege of examining this existing research to extract crucial insights for our project. Special thanks to Alessandro Prette from the UniCredit Italia team for his invaluable assistance in this phase. He provided a comprehensive walkthrough of the pertinent research, generously sharing the team's findings and learnings with existing commercial engagement functionalities, particularly from their recent journey in designing some of the recent functionalities in this stream

Key insights included:

1.

Desire for Personalization

The digital age has brought forth the demand for personalized experiences. Users now expect to receive offers and services tailored to their unique needs, relying on technology to understand their preferences and suggest accordingly. They prefered to be "recognized" and "understood" by the system.

2.

Relevance is Key

Several users mentioned that they would prefer recommendations that are timely and aligned with their current life events or financial behaviors, rather than generic suggestions.

3.

Privacy Concerns

A significant percentage of users were wary of how their data was being utilized. Transparency in AI-driven recommendations was a recurring theme.

4.

Feedback Collection Mechanism

A considerable portion of users indicated that they wanted an avenue to provide feedback, especially regarding personalised content. This showcased a user base eager to engage in a dialogue with the bank, emphasizing the need for a two-way communication channel.

5.

Feature Overload

Some users felt overwhelmed by the plethora of features, suggesting a need for simplification and better organization.

COMPETITOR ANALYSIS

Exploring Trends and Best Practices in Commercial Engagement

In the dynamic world of digital banking, it's imperative to understand the competitive landscape to remain ahead of the curve. To ensure a holistic understanding, I joined forces with my Product Manager, Alessandro Previati. Together, we benchmarked big competitors especially those that have carved a niche as digital-only banking platforms such as Revolut, N26, Illimity, and several others. Through this exercise, we aimed to uncover emerging trends, best practices, industry standards, and potential areas where UniCredit could innovate and further strengthen its position.

Key Findings:

1.

User-Centric Personalization

Digital banks like Revolut and N26 have invested heavily in AI and data analytics to enhance their commercial engagement. The result is hyper-personalized product offers that feel individually tailored, increasing the likelihood of user engagement.

2.

Contextual Product Recommendations

Banking apps are increasingly leveraging real-time user actions. For instance, if a user is checking international flight prices, they might instantly receive a travel insurance or foreign exchange product offer.

3.

Frictionless Onboarding for New Products

Illimity and several others have streamlined the process of availing new banking products. With fewer clicks and minimal information requirements, users can seamlessly onboard new offerings, reducing drop-offs.

4.

Gamified Engagement

Some digital banks such as Vivid have introduced gamification elements where users can earn rewards or unlock premium features by availing certain banking products or reaching specific savings milestones.

5.

Interactive Financial Dashboards

Many competitors have integrated dashboards that not only display account summaries but also suggest relevant banking products based on spending habits, savings, and financial goals.

6.

Transparent Communication

In a world where privacy is a top concern, banks like N26 emphasize clear and concise communication about how user data is used to curate commercial offers, fostering trust.

7.

Cross-Platform Integration

Many competitors are creating synergies with other financial apps or services. For instance, integrating with investment apps or e-commerce platforms to offer relevant banking products at points of high user intent.

8.

Lifecycle Product Suggestions

Recognizing that financial needs evolve, certain apps have begun suggesting products based on life events or stages, such as graduation, marriage, or buying a home.

9.

Minimalist Design for Commercial Engagements

While the tendency might be to flood users with offers, leaders like Revolut have adopted a more minimalist approach, ensuring that commercial engagements are non-intrusive and blend seamlessly with the overall user experience.

10.

Feedback-driven Iterations

Continuous user feedback loops are in place with many digital banking platforms. These ensure that commercial engagement features evolve based on actual user preferences and pain points, rather than assumptions.

In conclusion, the competitive landscape shows a clear trend towards personalization, transparency, and user-centric design in commercial engagement strategies. The insights gleaned from this analysis can serve as a guiding light for further refining UniCredit's approach in this domain.

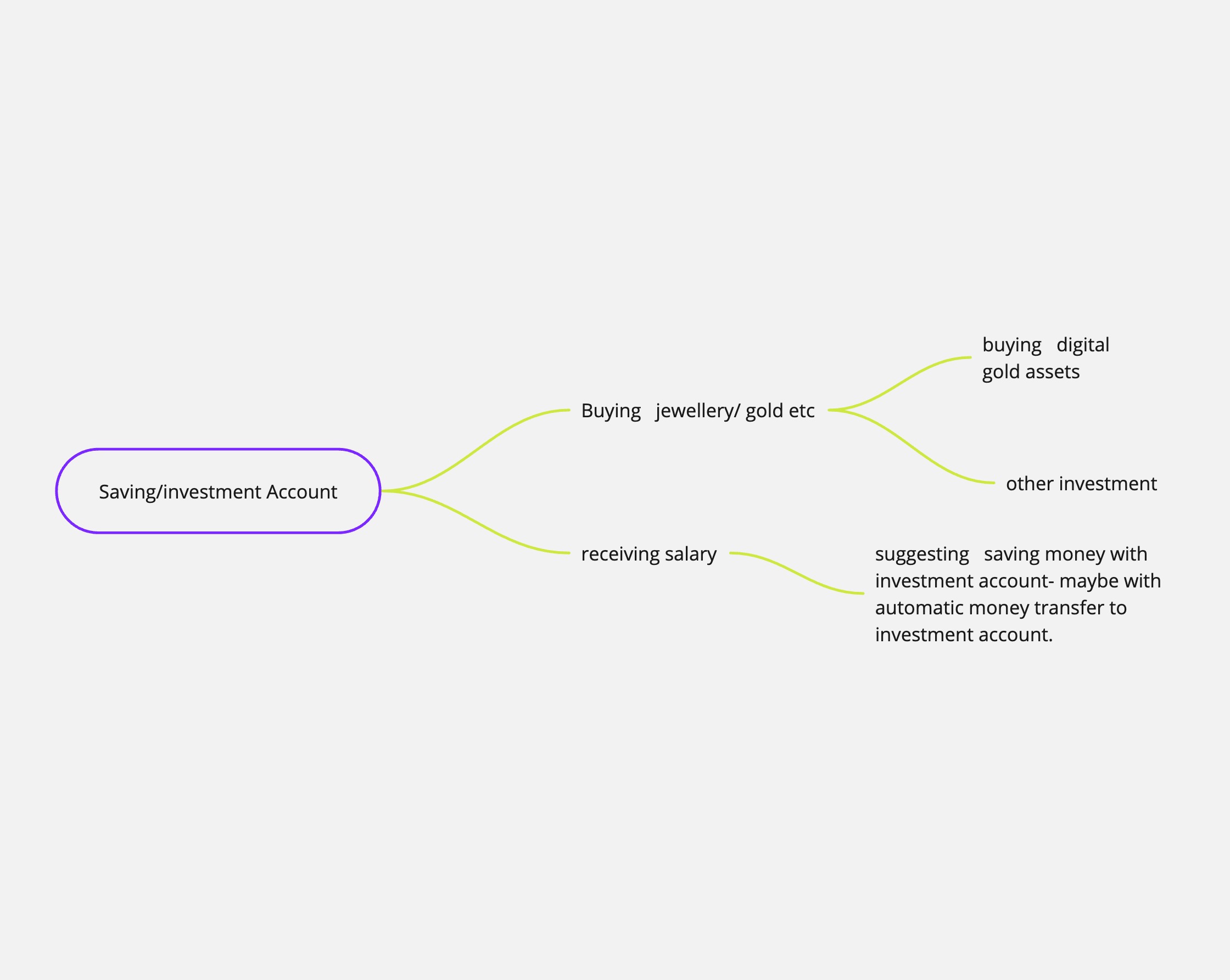

BEHAVIORAL MAPPING

Leveraging User Behaviors and Actions for Contextual and Tailored Engagements

Innovation in banking, more than from new technologies, stem from a deep understanding of users.

In my exploration of user interactions and behaviors, I sought to uncover opportunities for advancing commercial engagement. By studying the available data, I was able to discern patterns and behaviors that could be leveraged to recommend personalized product offers, ensuring they appeared contextually relevant and timely.

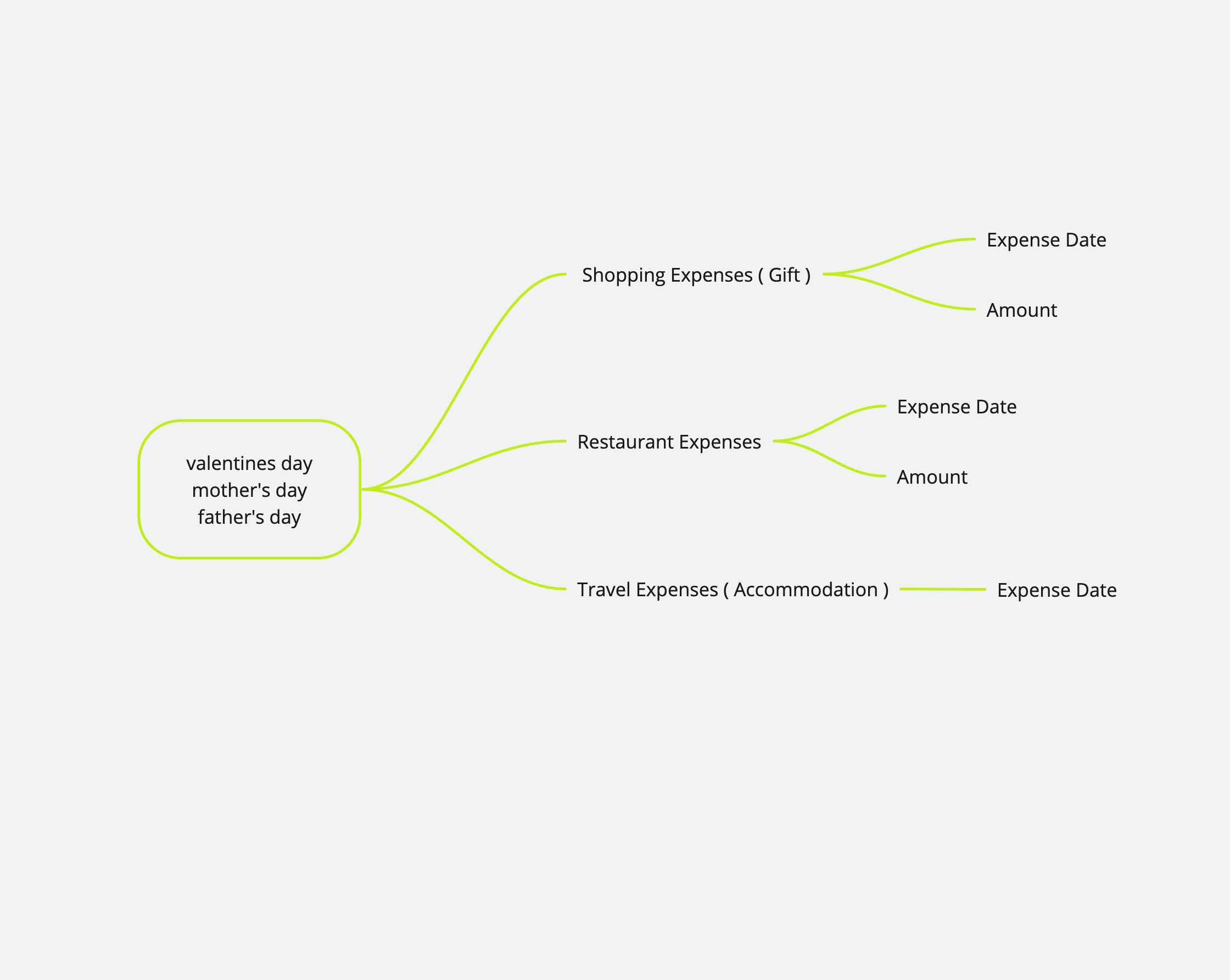

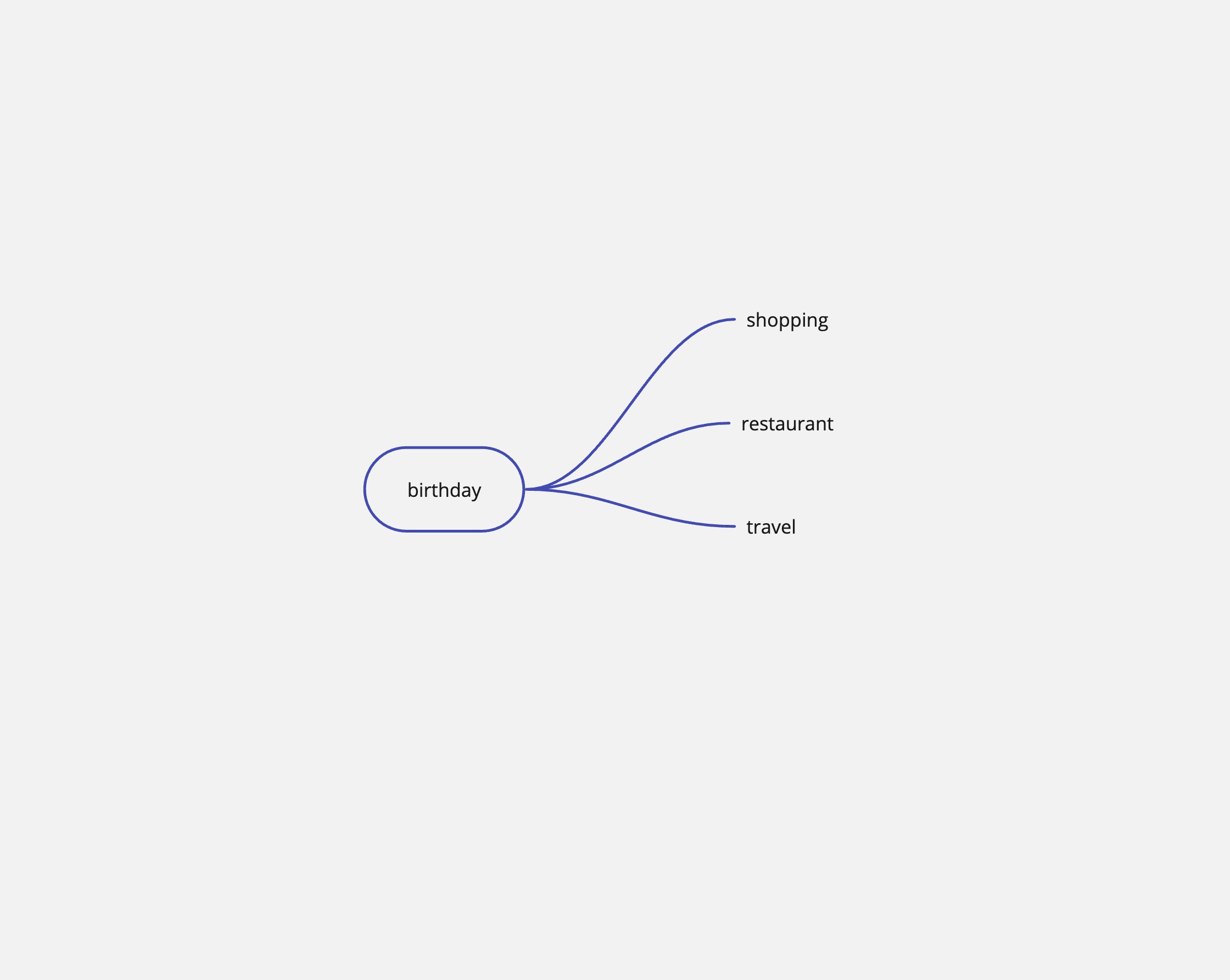

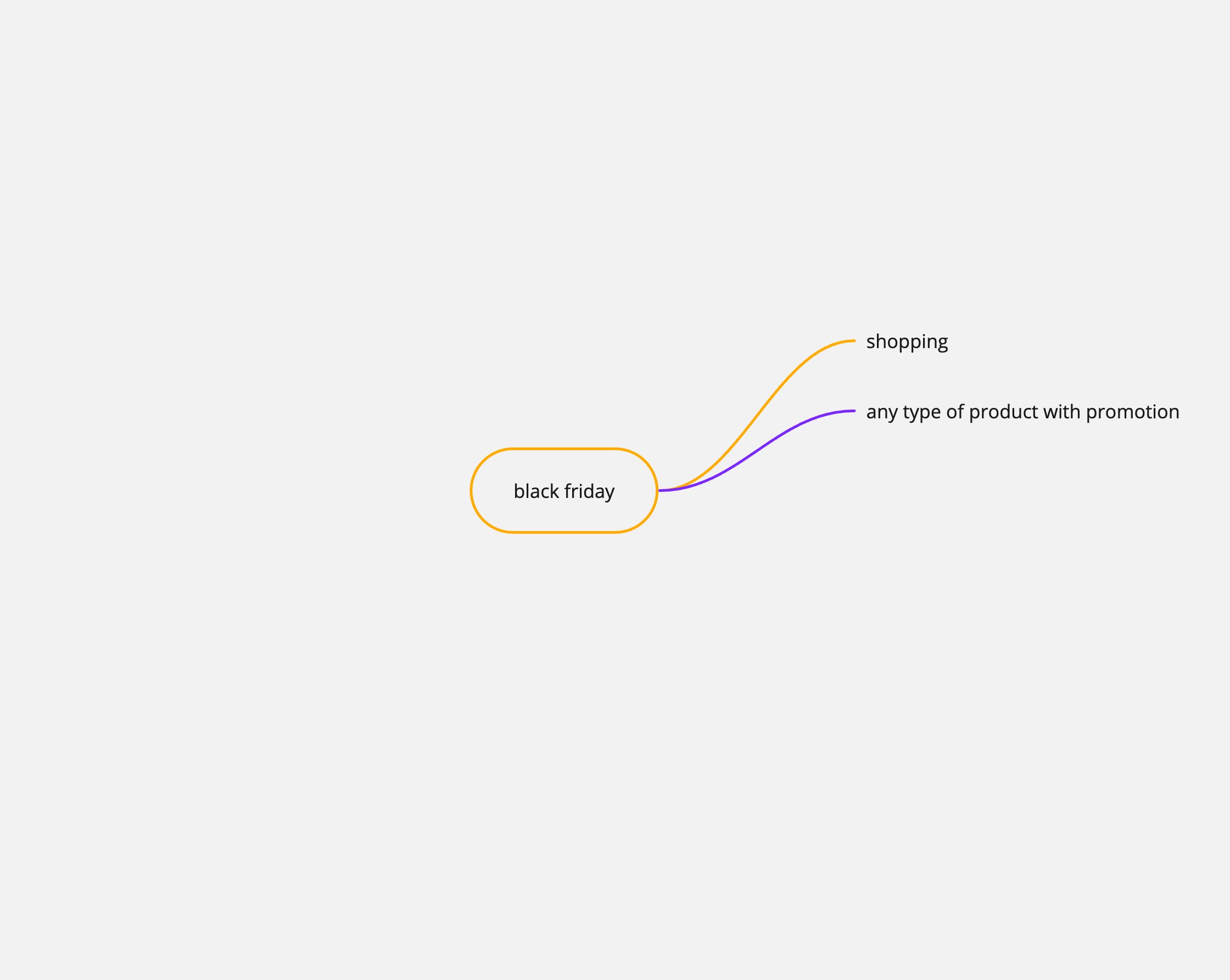

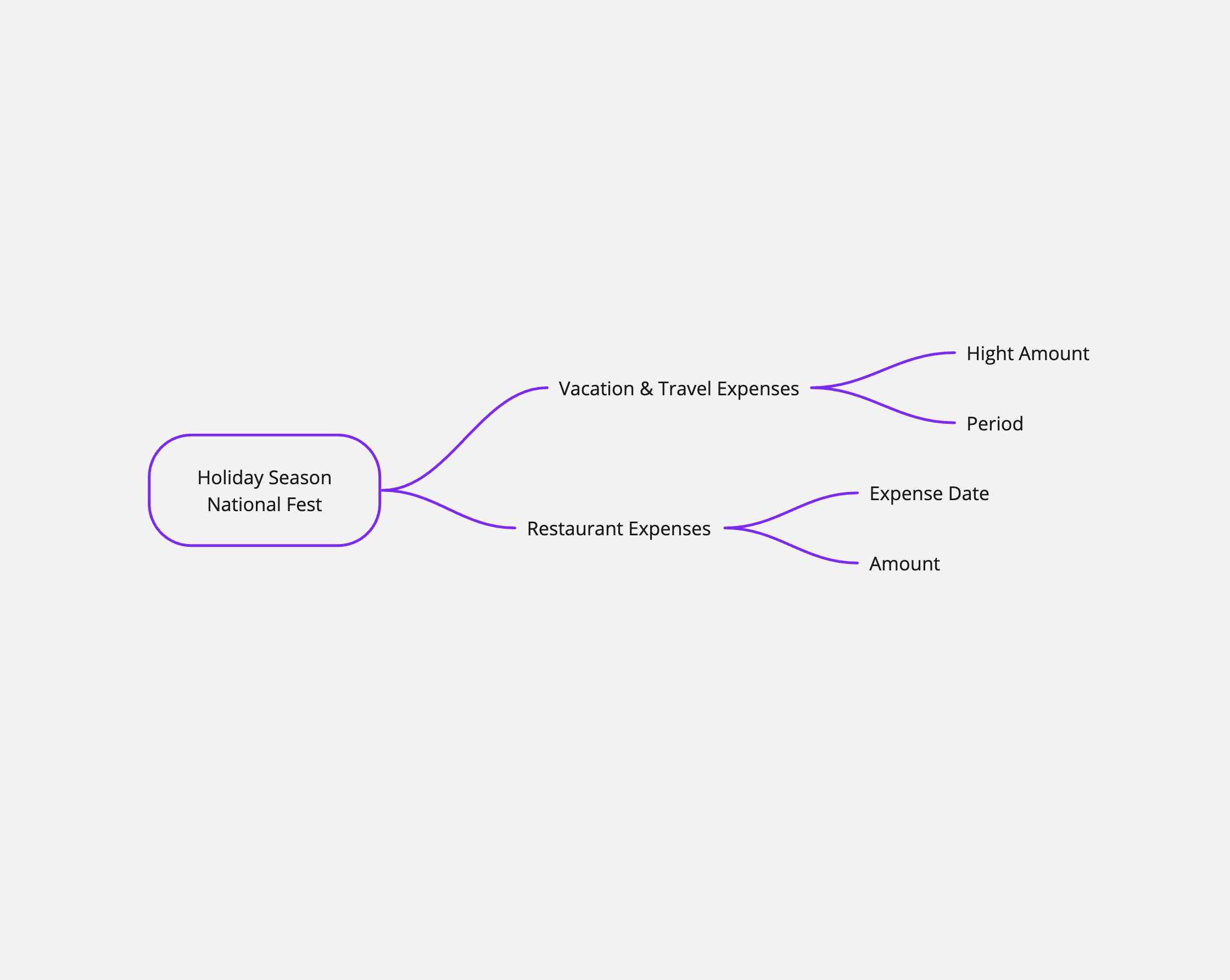

I identified two distinct categories of triggers: Behavioral Triggers and Contextual or Seasonal Triggers. Behavioral triggers are are based on individual user behaviors and transactions, reflecting a direct response to their actions. The key characteristic is the direct correlation between a user's action and the product offered, leveraging data-driven insights to provide personalized and relevant suggestions. Contextual or Seasonal Triggers are not based on individual actions but on a broader context that applies to a larger group of users. Such triggers take into account the time of the year, cultural events, holidays, or any significant period that might influence consumer behavior.

Importantly, these two categories are not mutually exclusive. By integrating Behavioral Triggers with Contextual or Seasonal Triggers, we can architect a system that is not only smarter but also more attuned to the multifaceted dynamics of user engagement.

Here's a closer examination of each category:

Behavioral Triggers:

Transactional Triggers:

Based on specific transactions made by the user, such as buying a house, a car, or booking a vacation.

Example: Offering home insurance after a user secures a mortgage.

Engagement Triggers:

Triggered by the user’s engagement level with the platform, like frequent logins, high activity, or completing a profile.

Example: Offering premium features or rewards to highly active users.

Lifestyle Triggers:

Based on lifestyle changes indicated by transactions or data, such as getting married, having a baby, or retirement.

Example: Suggesting a family health insurance plan after transactions related to childbirth.

Financial Habit Triggers:

Triggered by patterns in financial habits, such as consistent savings, investment behavior, or recurring expenses.

Example: Recommending a higher yield savings account to a user who regularly saves money.

Inactivity Triggers:

Activated by a lack of user action over a period, indicating potential disengagement.

Example: Sending a re-engagement offer or feedback request after a period of user inactivity.

Contextual or Seasonal Triggers:

Time-based Triggers:

Related to specific times of the year, like holidays, seasons, or months.

Example: Offering travel insurance discounts during summer vacation season.

Event-based Triggers:

Tied to cultural, sports, or significant global events.

Example: Offering special deals on TVs or game tickets at the beginning of the football season.

Geographical Triggers:

Based on the user’s location, considering local events, weather conditions, or regional holidays.

Example: Suggesting storm insurance in areas entering a monsoon season.

Economic Triggers:

Related to broader economic changes, like interest rate fluctuations, market downturns, or tax seasons.

Example: Advising on refinancing options when interest rates drop.

Demographic Triggers:

Linked to the demographic details of the user base, such as age, profession, or family size.

Example: Offering student loan products around graduation season.

Cultural Triggers:

Related to cultural holidays, festivals, or traditions.

Example: Promoting special investment plans during the New Year.

Click and drag horizontally to navigate in the gallery.

Swipe left or right to navigate in the gallery

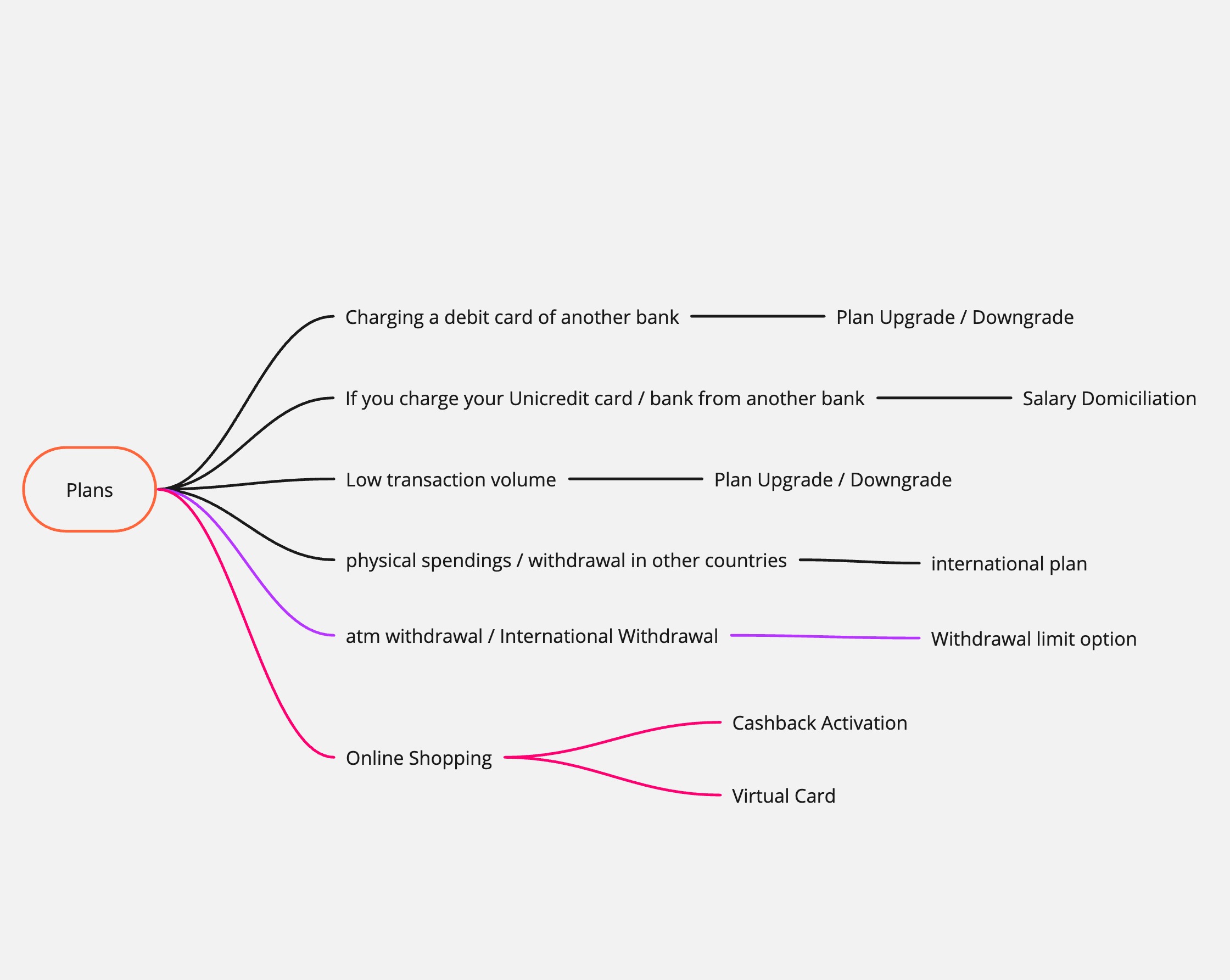

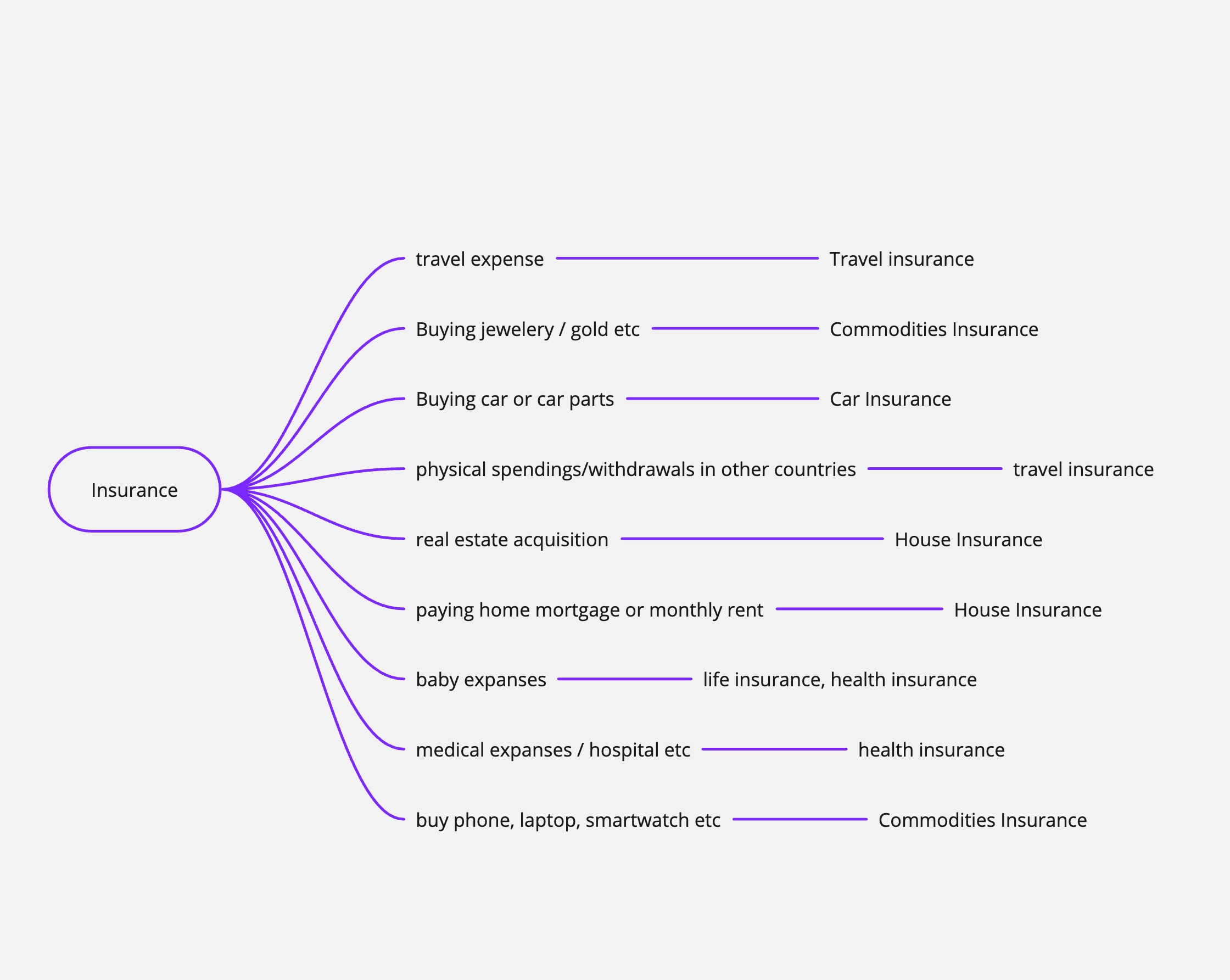

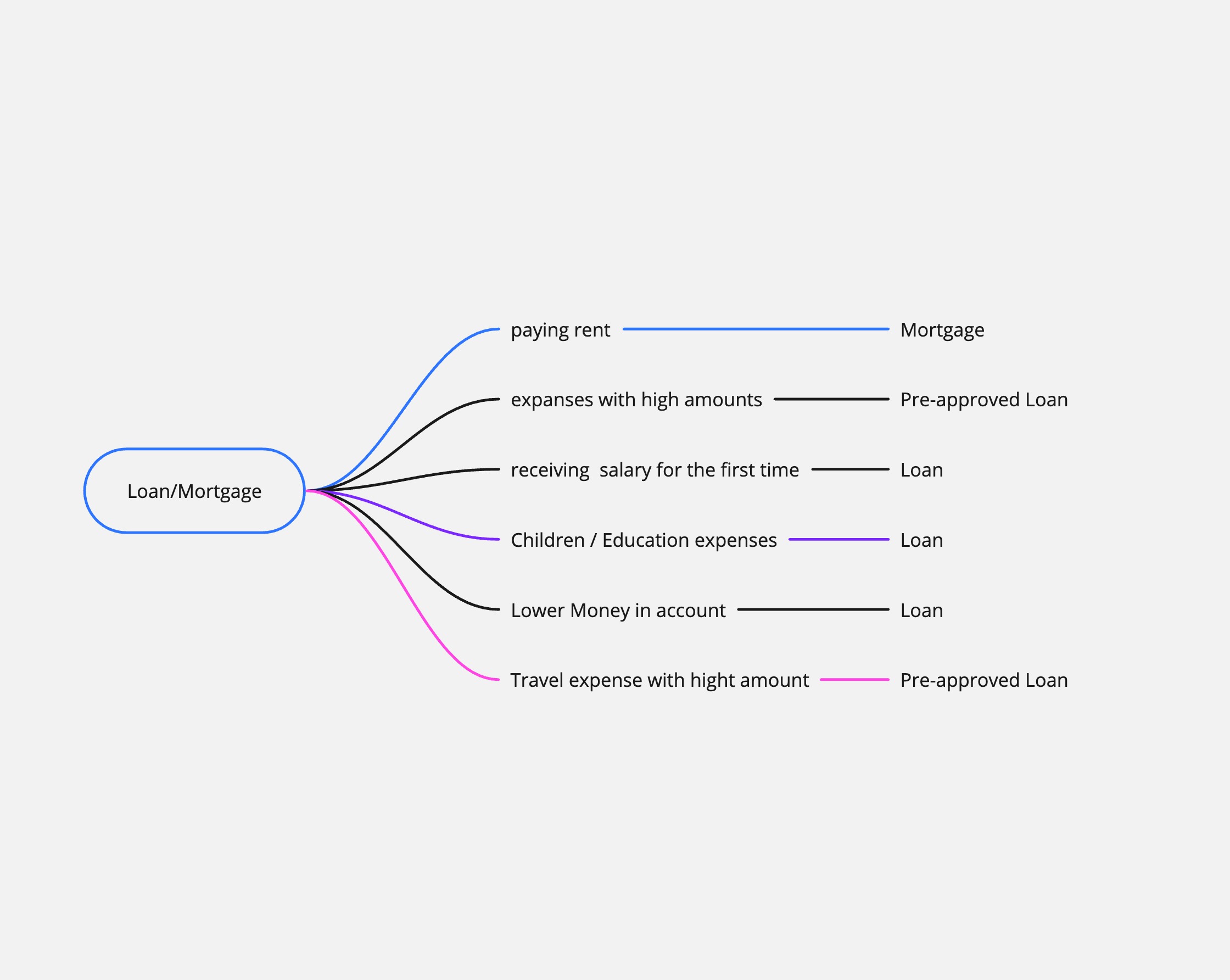

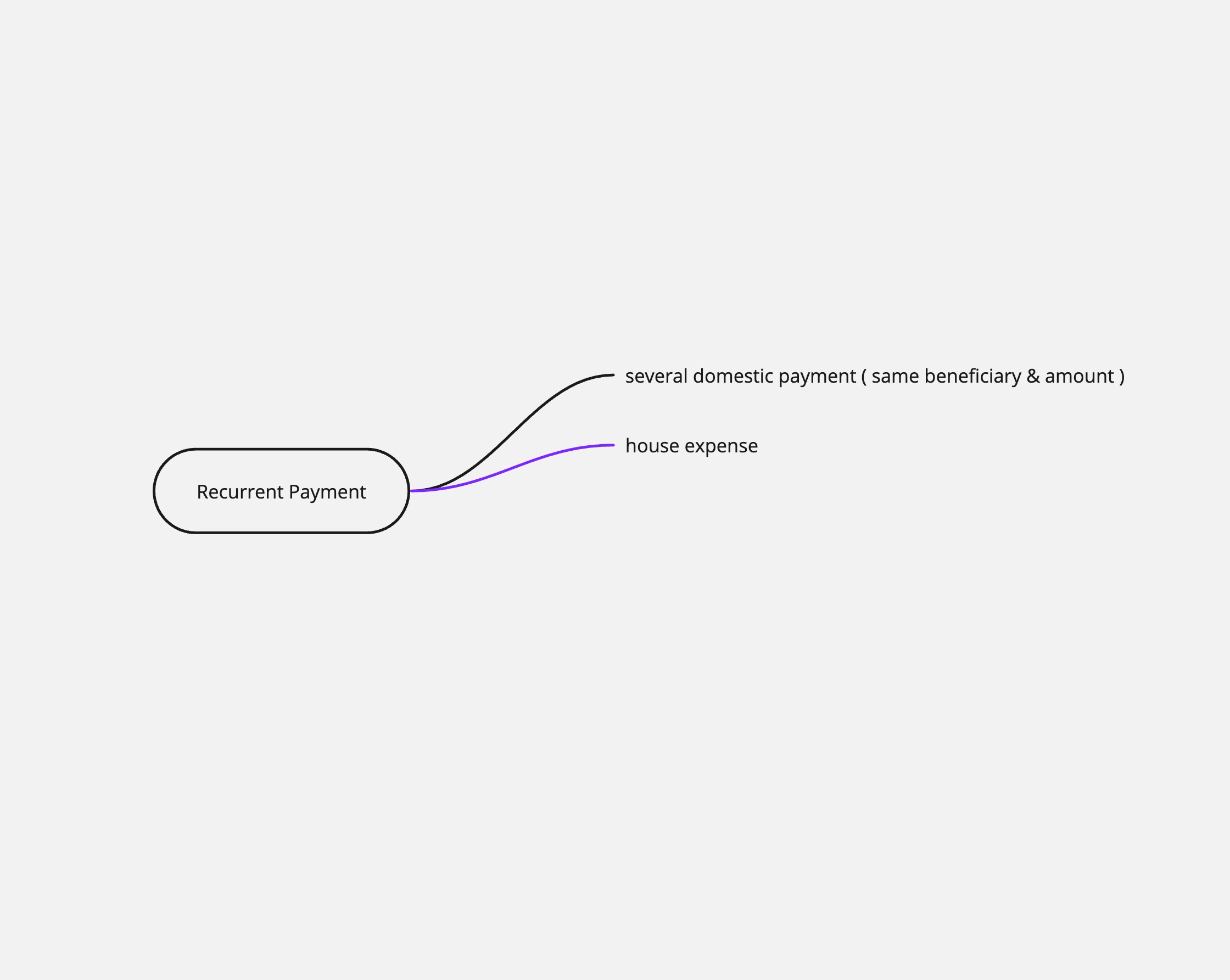

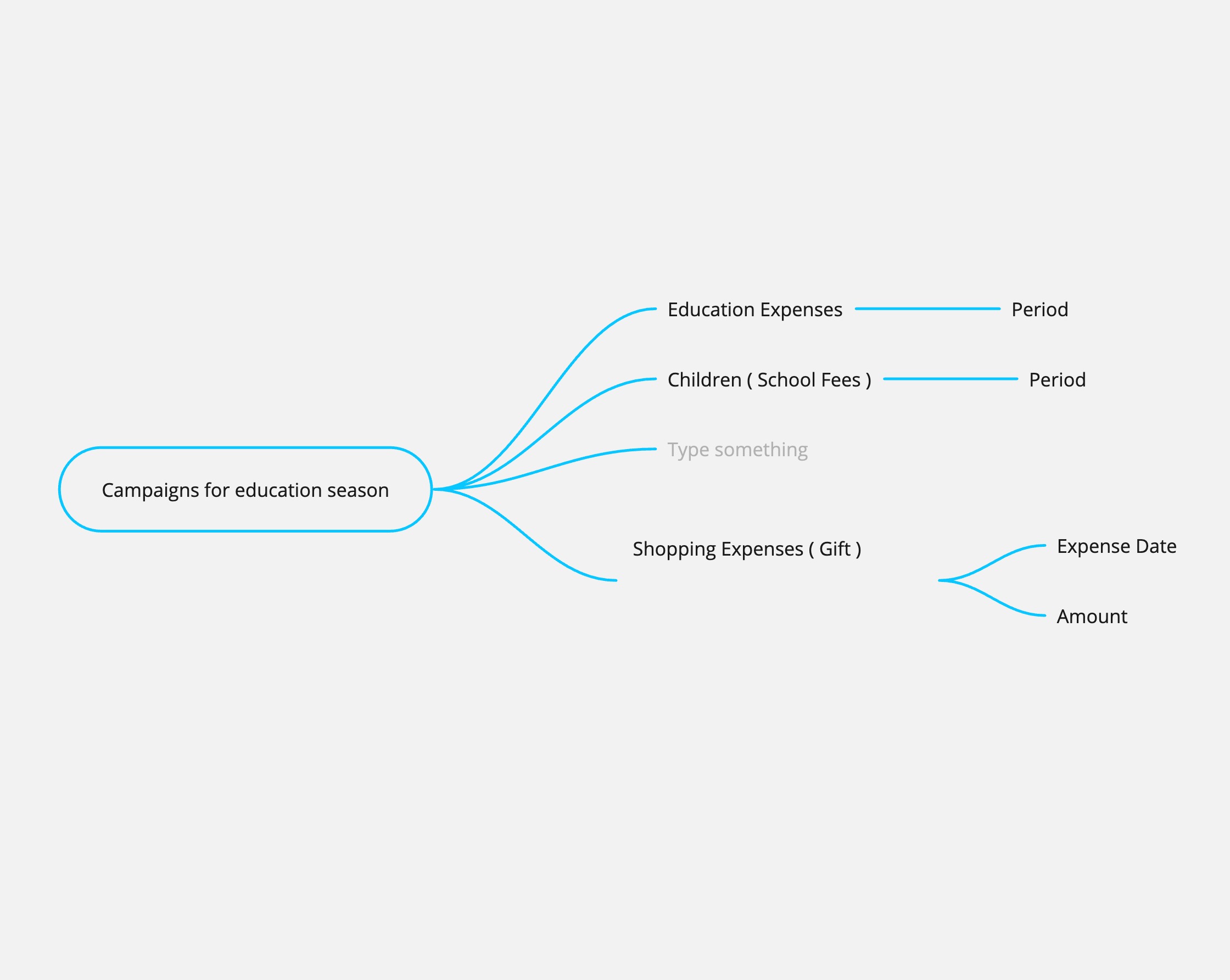

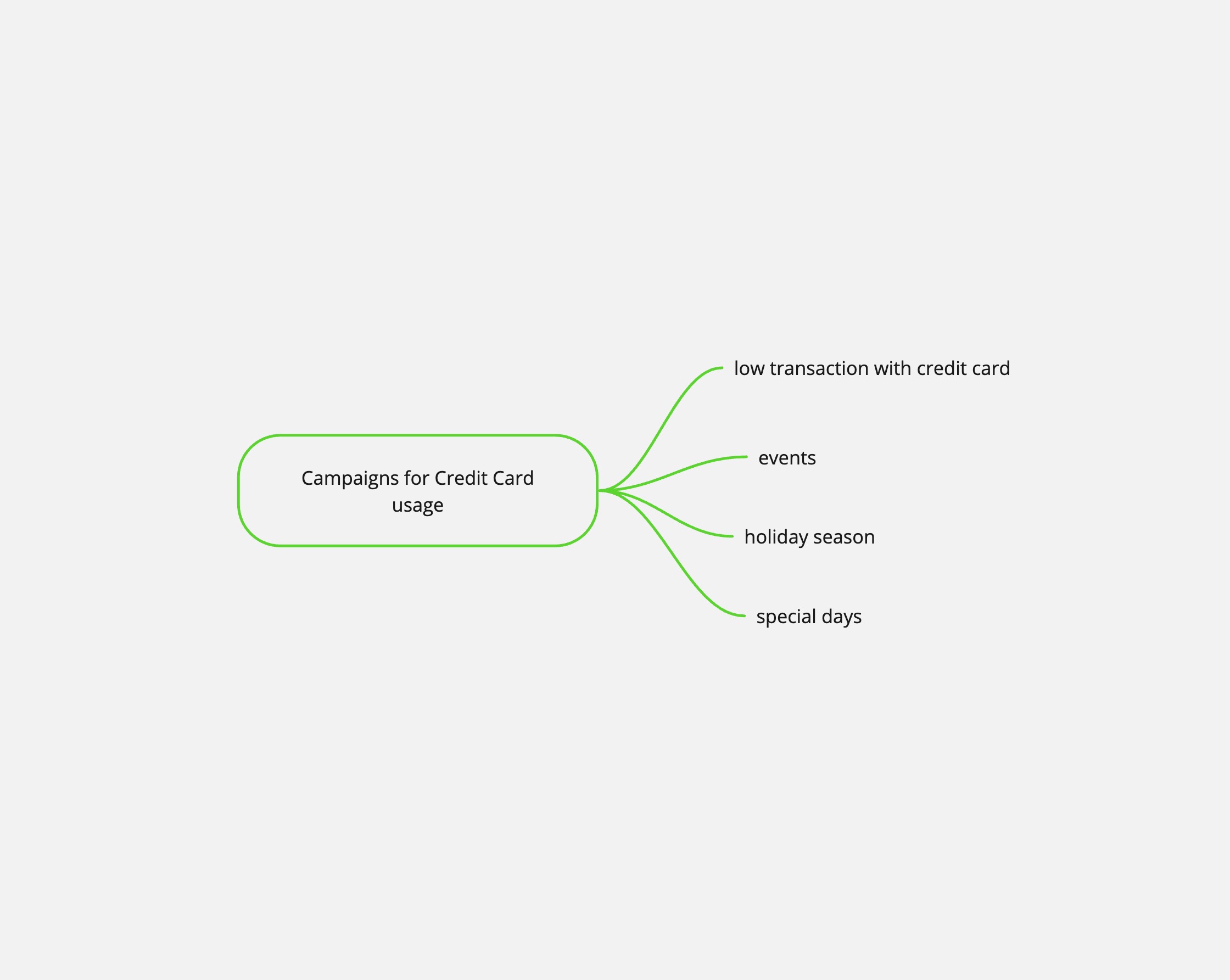

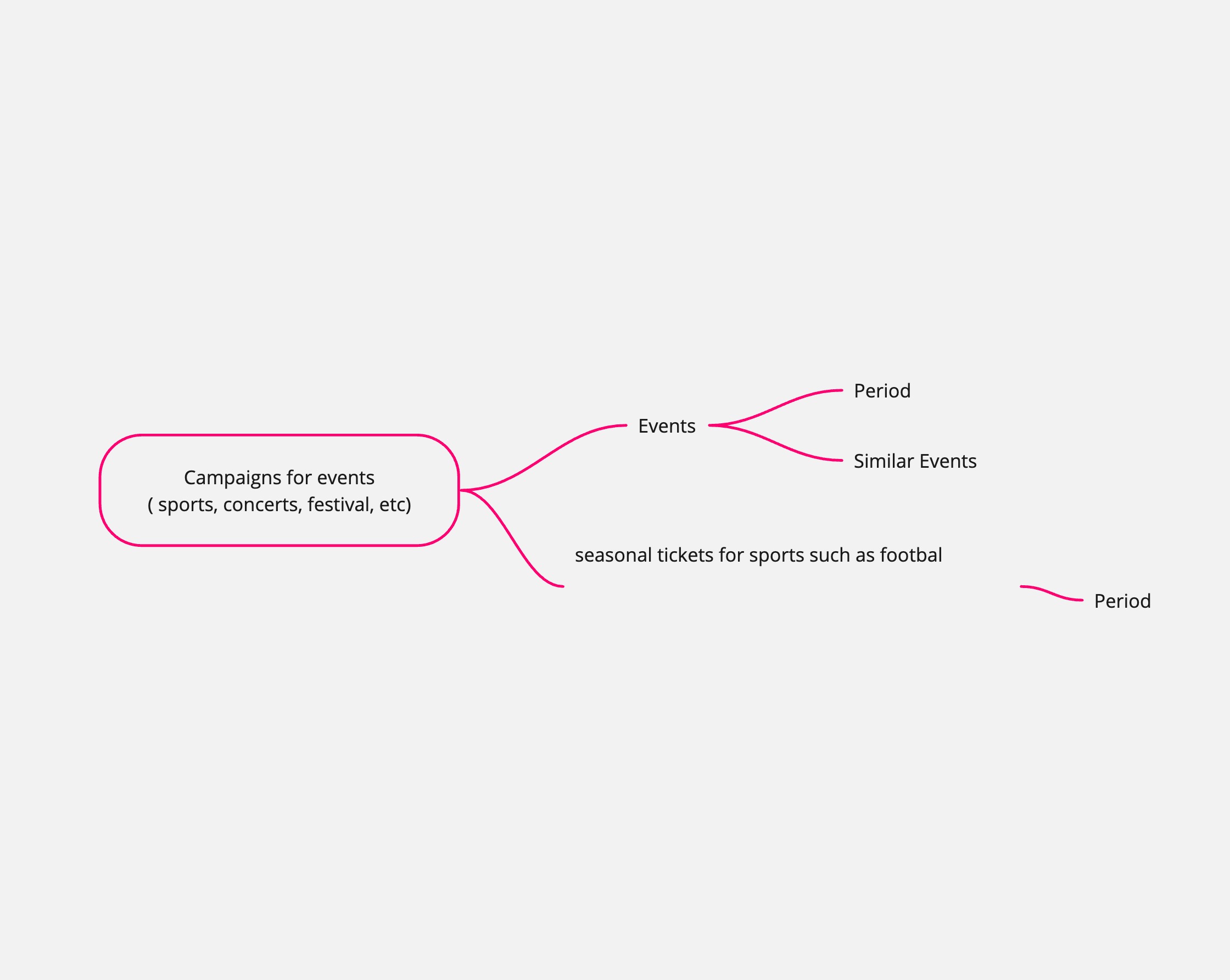

Image showcasing the intricate map of product recommendations based on user behaviors and contextual or seasonal triggers potential:

In conclusion, carefully analyzing user behaviors and the broader context has revealed a wealth of engagement opportunities. By dividing triggers into Behavioral and Contextual or Seasonal categories, we've set the stage for a smart engagement system. This system is quick to adapt to individual user actions and can also predict needs based on common patterns and important times of the year. Moving forward, these insights will be fundamental in our efforts to provide not just personalized but also forward-thinking user experiences, fostering deeper connections and enhancing commercial engagement in a manner that's both empathetic and effective.

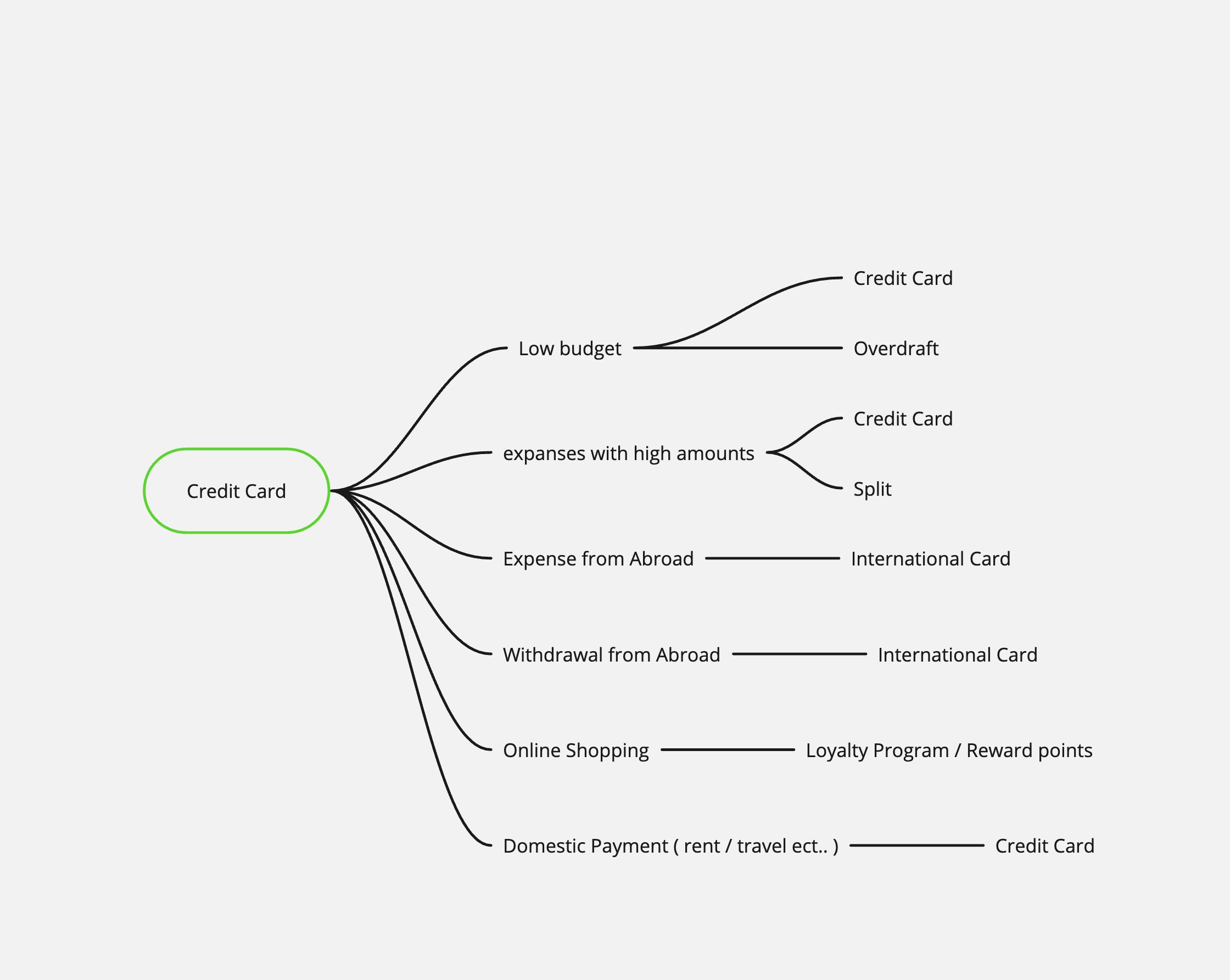

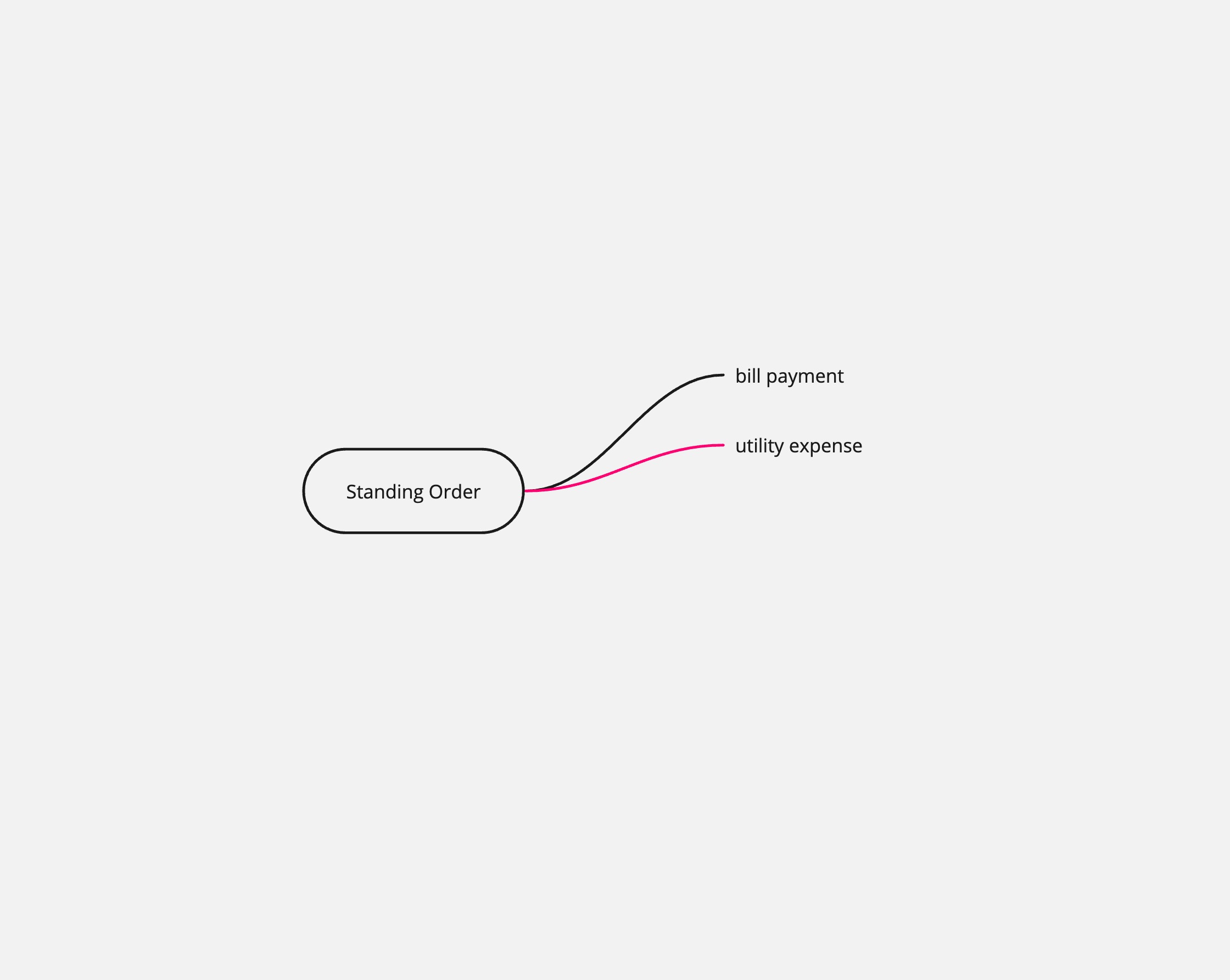

WORKSHOP

Fostering a Collective Vision

Recognizing the diverse user base of Unicredit, I organized a workshop involving representatives from every country where Unicredit operates. This interactive session aimed to gather feedback, understand specific regional preferences, and prioritize features, ensuring a shared vision and direction for the commercial engagement system.

To ensure that the newly designed system catered to specific regional needs and diverse user bases Unicredit has, I organized workshops involving representatives from all countries Unicredit operates in. This interactive session aimed to gather feedback, understand specific regional preferences, and jointly prioritize features, ensuring a shared vision and direction for the commercial engagement system.

Cross-country Collaboration

These collaborative sessions were conducted with the participation of the design team, UniCredit Governance leadership, and ambassadors from every Unicredit-operating country.

To foster seamless cooperation, especially in a virtual setting, platforms like Teams for discussion and Miro for visual conceptualization were employed.

Cross-country workshop conducted using Miro for Commercial Engagement

Feedback Loop

These collaborative sessions were conducted with the participation of the design team, UniCredit Governance leadership, and ambassadors from every Unicredit-operating country.

To foster seamless cooperation, especially in a virtual setting, platforms like Teams for discussion and Miro for visual conceptualization were employed.

Prioritization

Following feedback-driven iterations, the final curated designs encapsulating the new commercial engagement ecosystem were showcased and went through voting using the Dot Voting methodology for identifying components that has the highest importance for bank to focus on collectively. This feedback was methodically distilled into a strategic roadmap highlighting immediate needs, and longer-term goals.

The Dot Voting methodology for identifying components that has the highest importance for bank to focus on collectively

SOLUTION

Harmonizing User Experience: Designing with Empathy in a Digital Banking Era

In a digital age dominated by evolving user expectations and the relentless advance of technological innovations, the challenge and opportunity lay in creating a balanced, effective, and meaningful commercial engagement solution. For UniCredit, the imperative was to prioritize users while leveraging the power of technology and data to enhance their banking journey. The subsequent solutions detail our journey in understanding user and thoughtfully integrating new features. Each strategic move aims to resonate deeply with the user, ensuring a harmonious blend of technology and user-centricity.

1. User-Centric Guidelines

Established principles and recommendations for the bank to ensure the commercial engagement features were user-friendly, non-intrusive, and respectful of user privacy. These guidelines are also made to be followed by us in designing the new unified commercial engagement suit but they are also handed to Unicredit for following in the future development.

One of the most crucial aspects was to design guidelines that centered around human experience. It was paramount to ensure that the recommendation system was perceived as helpful rather than intrusive. The guidelines emphasized user privacy, reduced overt commercialization, and promoted a genuine understanding of user needs.

In the realm of digital engagement, the most profound connections are those rooted in understanding and trust.

Human-centric Guidelines for Commercial Engagement

1.

Friendly Tone and Personalization

Use a warm, friendly tone in all commercial engagement messages and accompanying illustrations.

Personalize recommendations to ensure relevancy to the user's financial habits and preferences.

2.

User Control

Users should find it easy to decline AI recommendations or offers if they're not interested. Never make it cumbersome to reject or turn off suggestions.

Allow users to easily toggle on/off floating ads or recommendations.

3.

Don't Obscure Primary Functionalities

Always prioritize primary banking features. Commercial engagements should never interfere with or diminish the user's core banking experience.

Never obscure primary functionalities with engagement prompts.

Large commercials or banners should be limited and only displayed when a user is primarily engaging with one product to avoid overwhelming them.

4.

Consistency Across Features

Ensure all features, whether old or new, adhere to established design and interaction patterns. Uniformity in user experience is vital for user comfort and trust.

5.

Smooth Animations & Transitions

Employ subtle animations when introducing recommendations or new offers, ensuring they're not disruptive but of offer a fluid user experience.

Never obscure primary functionalities with engagement prompts.

6.

Subtle Integration

Commercial messages should seamlessly blend into the content, especially within transactional spaces.

Avoid creating a dominant or overly commercial atmosphere that might alienate users.

7.

Privacy and Respect

Guard against making the platform feel like an invasive advertising tool.

Ensure users never feel their private information is being misused or overexploited.

8.

Modularity in Design

Craft commercial engagement features modularly. This approach permits adaptation or customization to suit diverse markets or user groups.

9.

Interactive Engagements

Incorporate financial simulations, investment modeling, and real-time budgeting tools to promote deeper user engagement.

10.

Gamified Loyalty Programs

Reward users for their engagement and loyalty with cashbacks, points, or unique offers.

11.

Simplified Onboarding

Ensure any new commercial feature is introduced with a clear, intuitive, and quick onboarding process.

12.

Holistic Financial Wellness

Expand offerings beyond basic banking. Provide tools, insights, and advice for users' comprehensive financial health.

13.

Feedback Loops

Develop a robust feedback mechanism for users to share their thoughts on commercial engagement features. This feedback should be periodically reviewed and integrated into feature refinements.

14.

Humanizing Digital Interactions

Introduce personalized greetings, use softer tones for copy and illustrations, and deploy smooth animations to emulate human-like interactions.

15.

Transparent Recommendations

Maintain user trust by being transparent about how their data is used. Implement features like "Why am I seeing this?" to explain AI-driven recommendations.

16.

Shared Vision and Regional Adaptation

Take into account specific regional preferences and needs, ensuring that the commercial engagement system resonates with all user bases.

2. Showcasing Commercial Engagement Ecosystem

Introduced new features to leveraging AI and data-driven techniques to offer users In redefining Unicredit's commercial engagement strategy, the cornerstone of our approach was the seamless integration of AI and data analytics with user-centered design. Our objective was to transform the digital interface into a proactive, intuitive ecosystem that not only understands the user's immediate needs but also anticipates the ones that could emerge in the future. Here's how we bridged technology with empathy to create a system that resonates with the users:

Intelligent Product Recommendations

Our system by analyzing transactional data and user behaviors, it identifies opportunities to present users with offers that are relevant and timely. Here are some example scenarios:

- If a user booked a holiday to Japan, they would receive currency exchange rates or travel insurance options tailored to their trip.

- Another example is if a user purchased a vehicle, our system would smartly recommend - related insurance products, merging intuition with intelligence.

- A user who recently financed a home could receive suggestions on home insurance or interior design partnerships.

AI-Driven Recommendations

The fusion of data analytics and AI equips our system with the capability to understand and predict user needs. Each recommendation is tailored to feel personal and advantageous:

- For instance, consistent monthly rent payments are intelligently recognized, prompting suggestions for home loans or property insurance.

Designing a Cohesive System

Revamping the existing features while introducing new ones, we've sculpted a cohesive suite of commercial engagement features. The design ethos centered on being non-intrusive and genuinely helpful, ensuring users perceive the offers as valuable recommendations rather than disruptions.

Besides the addition of new features, some of the already existing features underwent a refinement process, aligning them with contemporary expectations of intuitiveness, usability, and clarity, all while maintaining the brand's integrity. Each feature has been thoughtfully designed to fit seamlessly within the broader digital ecosystem of Unicredit.

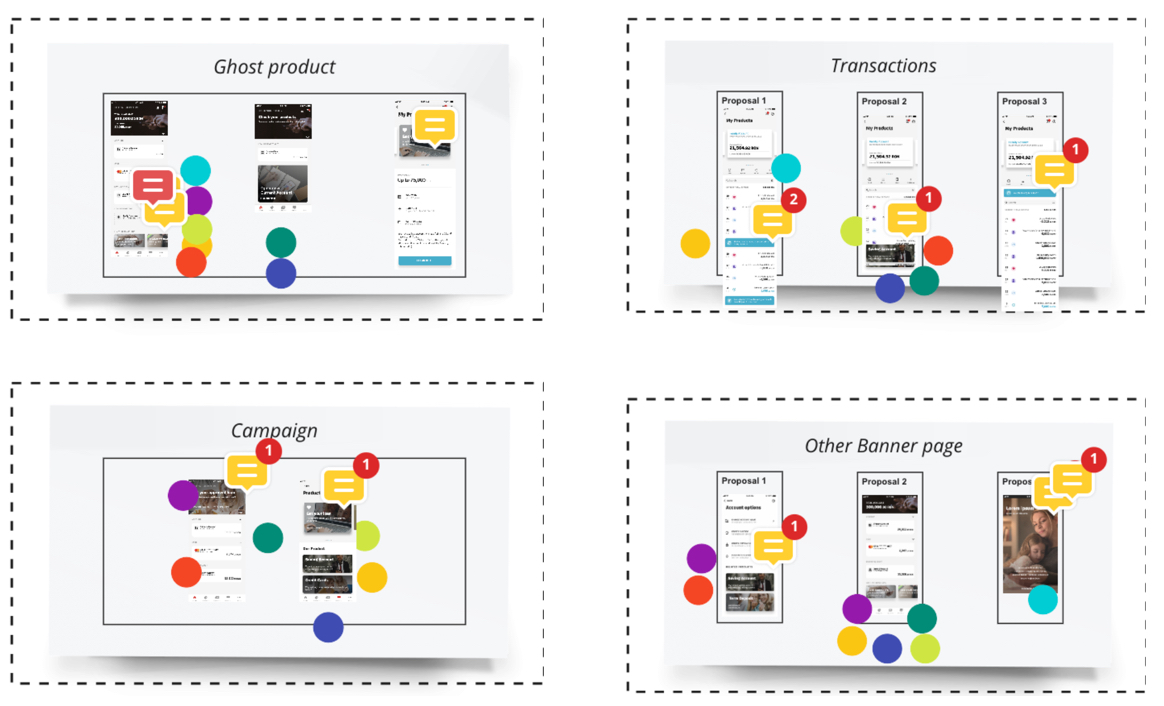

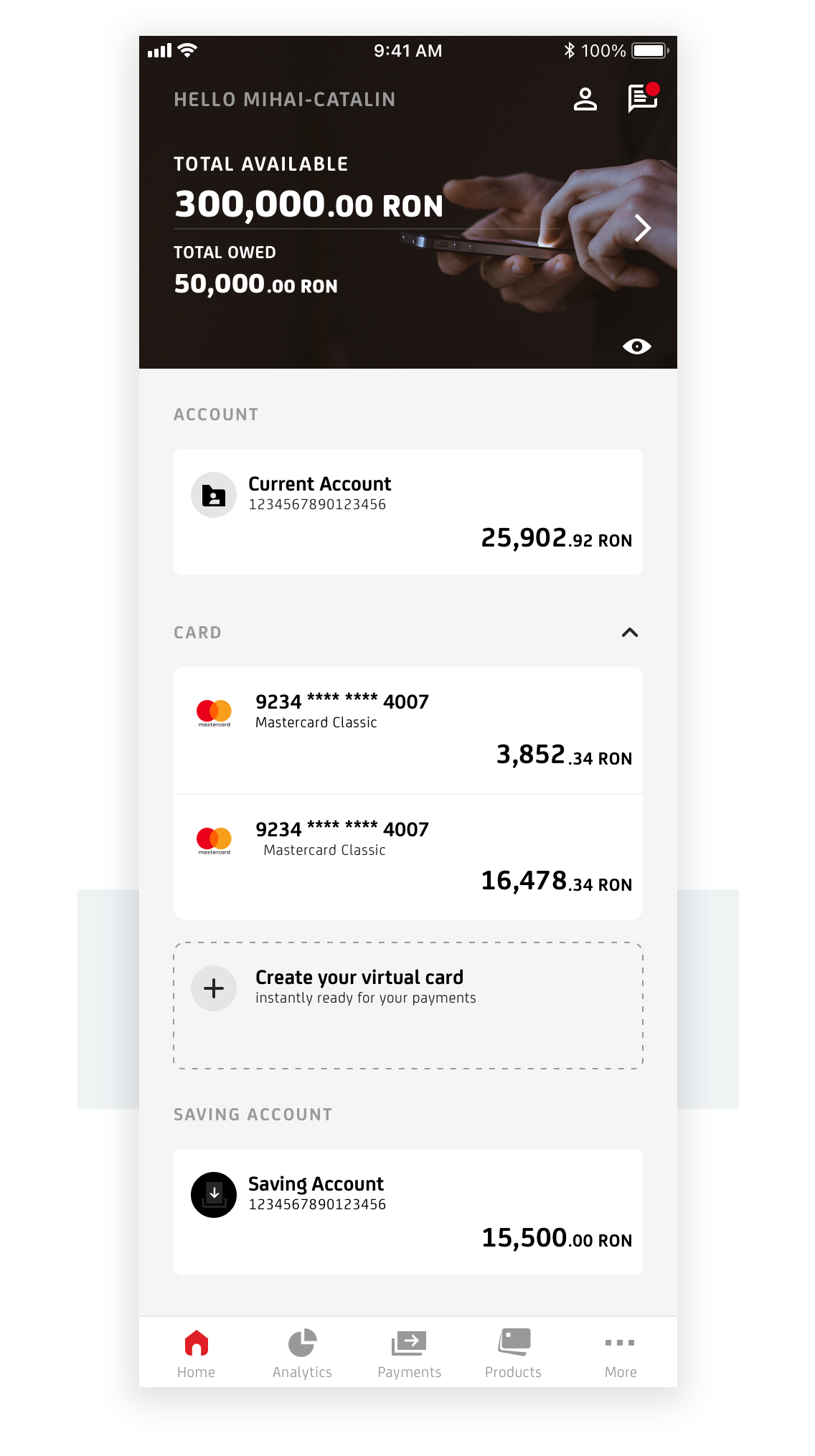

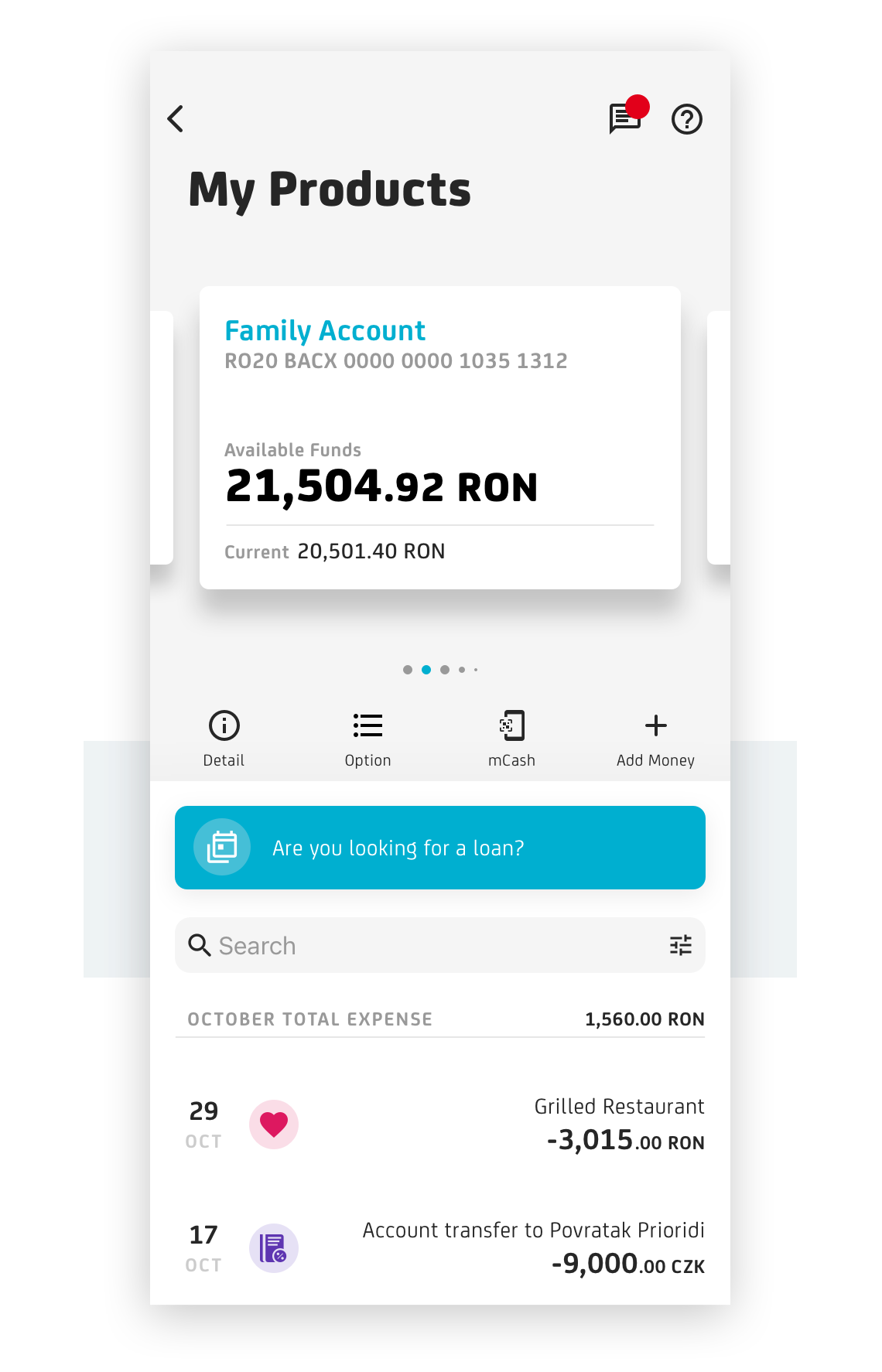

Cross Selling Strategy: Ghost Product on My Products Page

The Ghost Product feature on the My Products page epitomizes a strategic approach to cross-selling. Positioned at the conclusion of the product carousel, it introduces users to a relevant product offer, tailored to their needs. This intuitive design ensures that the offer appears as a natural extension of the user's existing portfolio, making it an effective nudge towards exploring new products. The visual appeal of the campaign banner, coupled with a clear call-to-action (CTA), engages users without overwhelming them.

This concept extends to the My Cards and My Accounts pages, ensuring consistency in user experience across different segments.

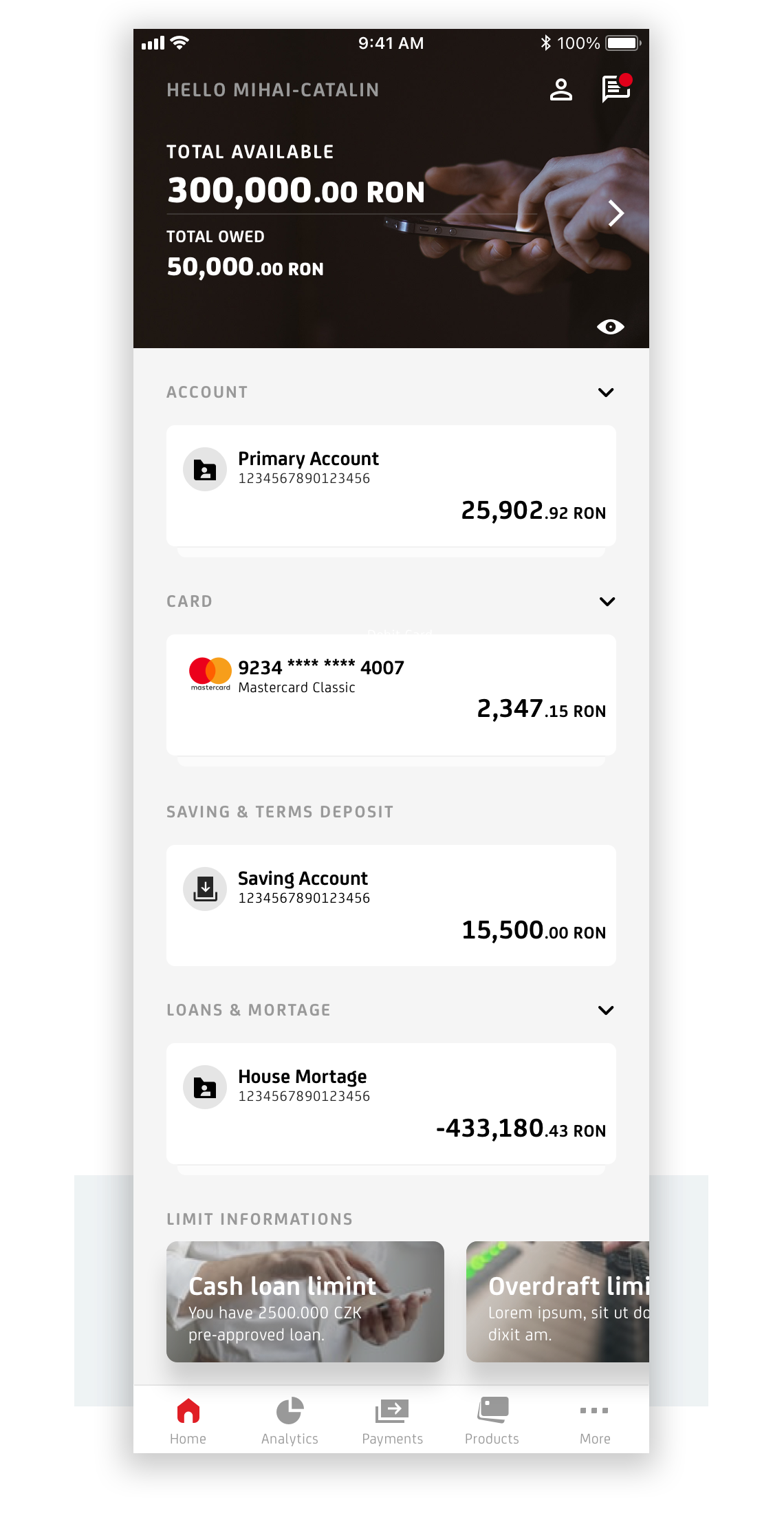

Cross Selling Strategy: Ghost Product on Home Page

AI to understand and predict user needs for more The Home Page Ghost Product strategy ingeniously fills product gaps in the user's portfolio. If a product is absent in a category, such as a savings account or a virtual card, a subtle and contextual product offer CTA occupies this space. This design choice is both functional and informative, guiding users towards beneficial products without disrupting their experience. The design’s subtlety is crucial in maintaining focus on the primary content, while still signaling potential opportunities to the user.

Banners with Swipe at the Bottom of the Homepage

The swipeable banners at the bottom of the homepage represent a thoughtful balance between visibility and non-intrusiveness. By placing these visually appealing banners at the end of the homepage content, they attract attention without detracting from the user's primary tasks. This design decision respects the user's journey while providing opportunities for further engagement.

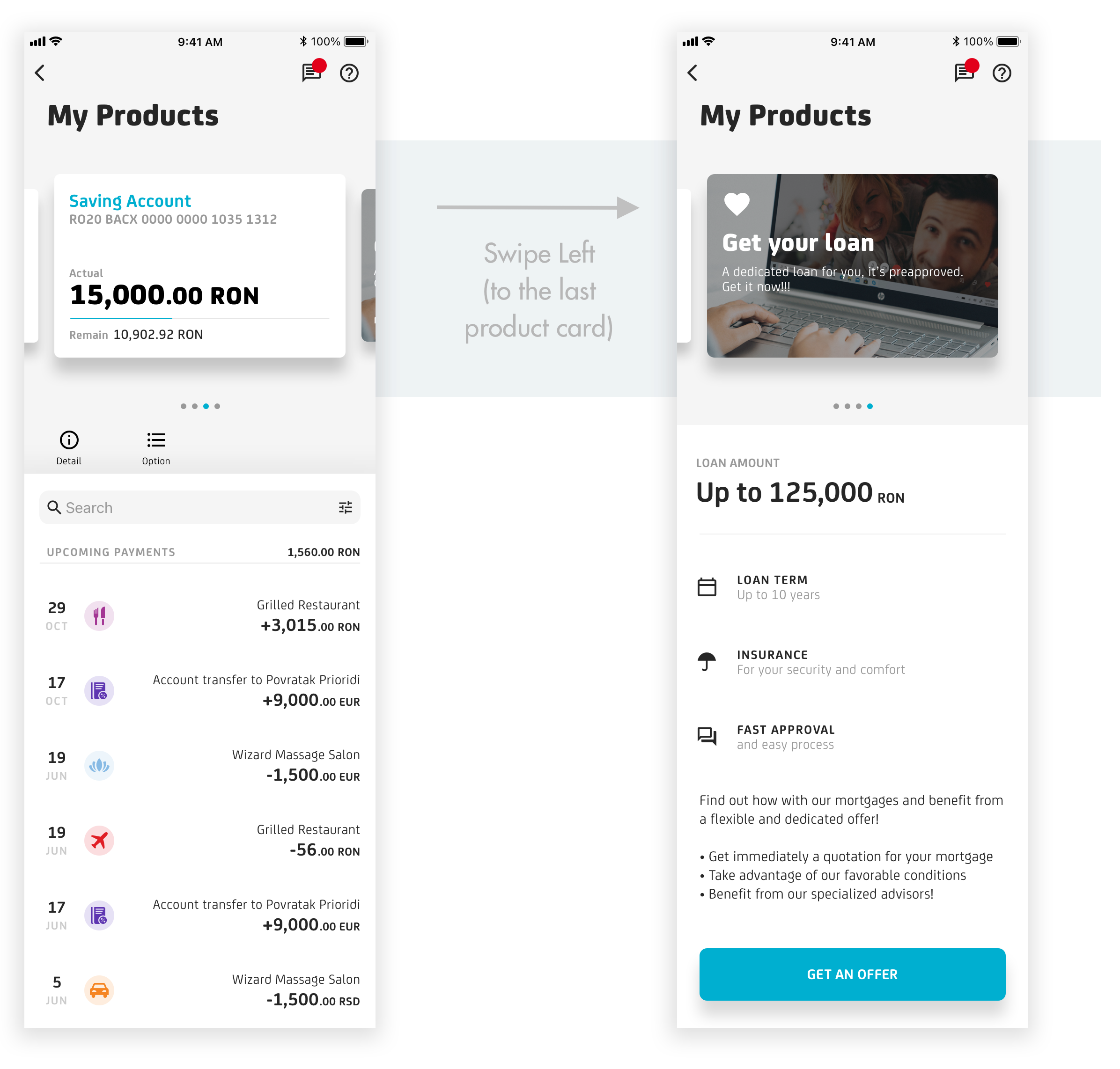

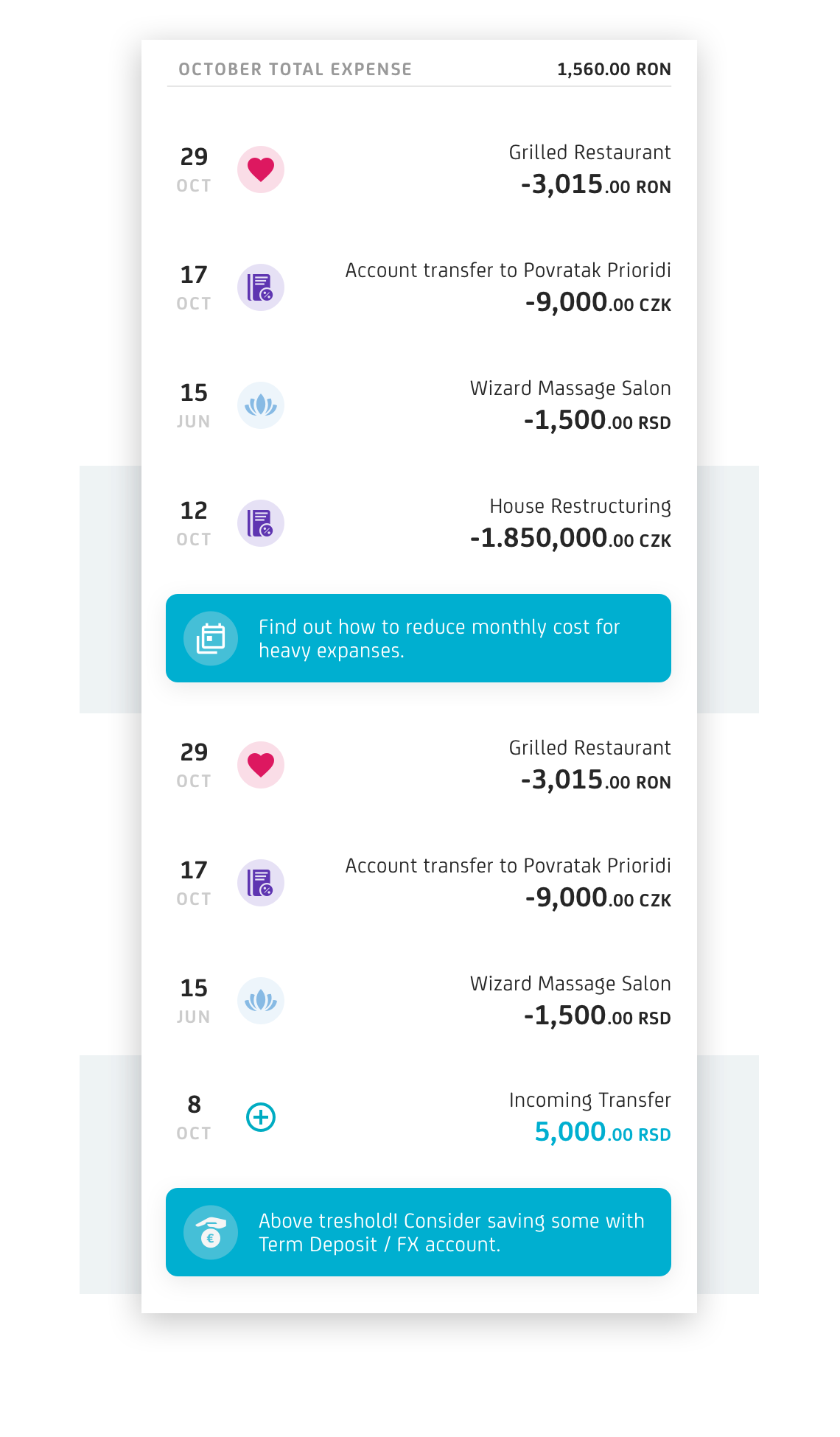

Intelligent Recommendations in the Transactions Page

Incorporating intelligent recommendations alongside relevant transactions is a hallmark of contextual design. This feature not only enhances the user experience by providing timely and relevant offers but also demonstrates the system's understanding of the user’s financial activities. For instance, suggesting a product to manage large expenses or to invest a substantial income, adds tangible value at the moment it's most relevant.

One Product Offer at the Top of Transactions

The redesigned feature of showcasing a single, pertinent product offer at the top of the transactions list serves as an unobtrusive yet effective method of user engagement. It's strategically placed to capture attention immediately upon reviewing transactions, offering a seamless integration of product discovery within the user's financial overview.

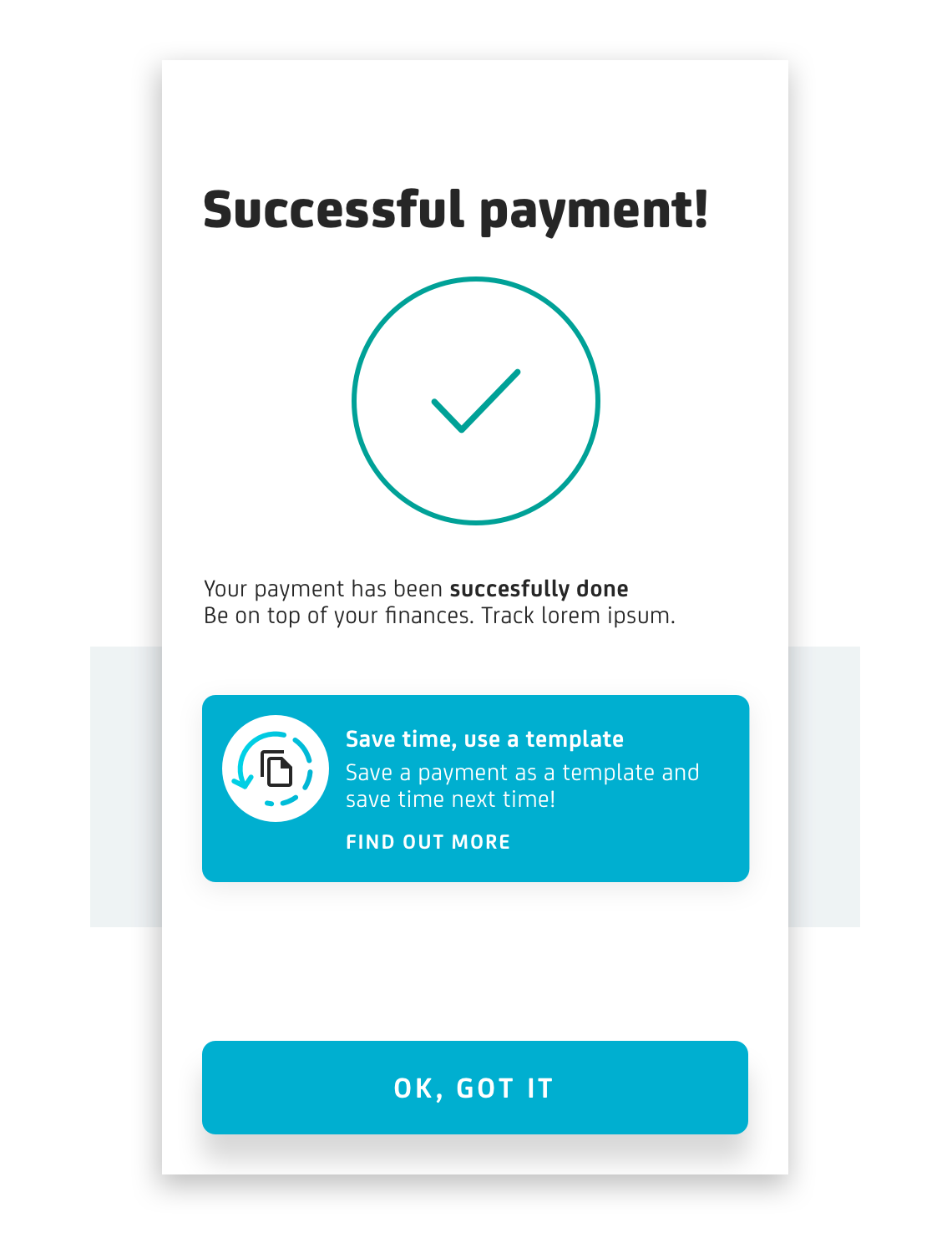

Product Offer in the Thank You Page

The Thank You Page product offer is an exemplar of leveraging opportune moments for engagement. By presenting relevant offers after a transaction's completion, it taps into the user's sense of accomplishment and openness to further actions. The redesign emphasizes visibility and accessibility, ensuring the offer is prominent without being intrusive. This strategic placement acknowledges the user's completed goal while simultaneously guiding them towards additional beneficial actions.

LEARNINGS & TAKEAWAYS

From Collaboration to Clarity

The collaborative process of enhancing and implementing commercial engagement features for Unicredit was both insightful and transformative. Here are the pivotal learnings and takeaways derived from this experience:

Learnings and Takeaways

1.

Diversity in Unity

The collaboration with representatives from different countries underlined the importance of a unified system. Yet, it was equally crucial to respect and accommodate the nuances of regional preferences, ensuring global consistency while offering local flexibility.

2.

Balancing Tech with Touch

AI and data can drive recommendations, but the human touch is irreplaceable. Ensuring the system is perceived as helpful required a delicate balance between technology and human-centric design.

3.

Trust is Non-negotiable

Banking is inherently built on trust. Any tool or feature, no matter how advanced, will only be embraced if users trust its intentions and outcomes. The importance of transparency and respect for privacy cannot be overstated.

4.

Evolving Landscape

While this project revamped and unified the commercial engagement system, it’s essential to understand the digital banking landscape together with user needs and technology is ever-evolving. While it was essential to address current needs, the vision had to encompass future developments. Thus, ensuring the system was adaptable and forward-looking was a key takeaway.

5.

Users First Approach

While it's essential to drive business goals, it should never come at the cost of user experience. Striking this balance was a constant learning process.

6.

Embrace AI More Holistically

Beyond just recommendations, there's an untapped potential in utilizing AI for predictive financial analyses and proactive user alerts. The scope of AI's application in enhancing user experience is vast and worthy of exploration.

7.

Simplicity is Golden

Despite the plethora of tools and data at our disposal, the principle of 'less is more' often prevailed. Simplified interfaces and clear messaging were reaffirmed as more effective than feature-loaded, complex designs.

CONCLUSION

A Look Back and Ahead

In our journey to redefine and elevate Unicredit's commercial engagement system, we encountered a multitude of challenges, learned invaluable lessons, and celebrated significant milestones. While technology and innovation acted as our tools, it was the users' needs, preferences, and trust that directed our path. This endeavor underlined the quintessential nature of harmonizing advanced technology with human-centric design, ensuring not only business growth but a deeper, more trusted connection with the users.

The culmination of our efforts has resulted in a system that is adaptable, user-friendly, and future-ready. It sets the stage for Unicredit to remain at the forefront of digital banking, leading with empathy and innovation. As we close this chapter, we do so with a keen eye on the horizon, knowing that the world of digital banking is ever-evolving and that our commitment to serving the user is perpetual.

Thanks for watching